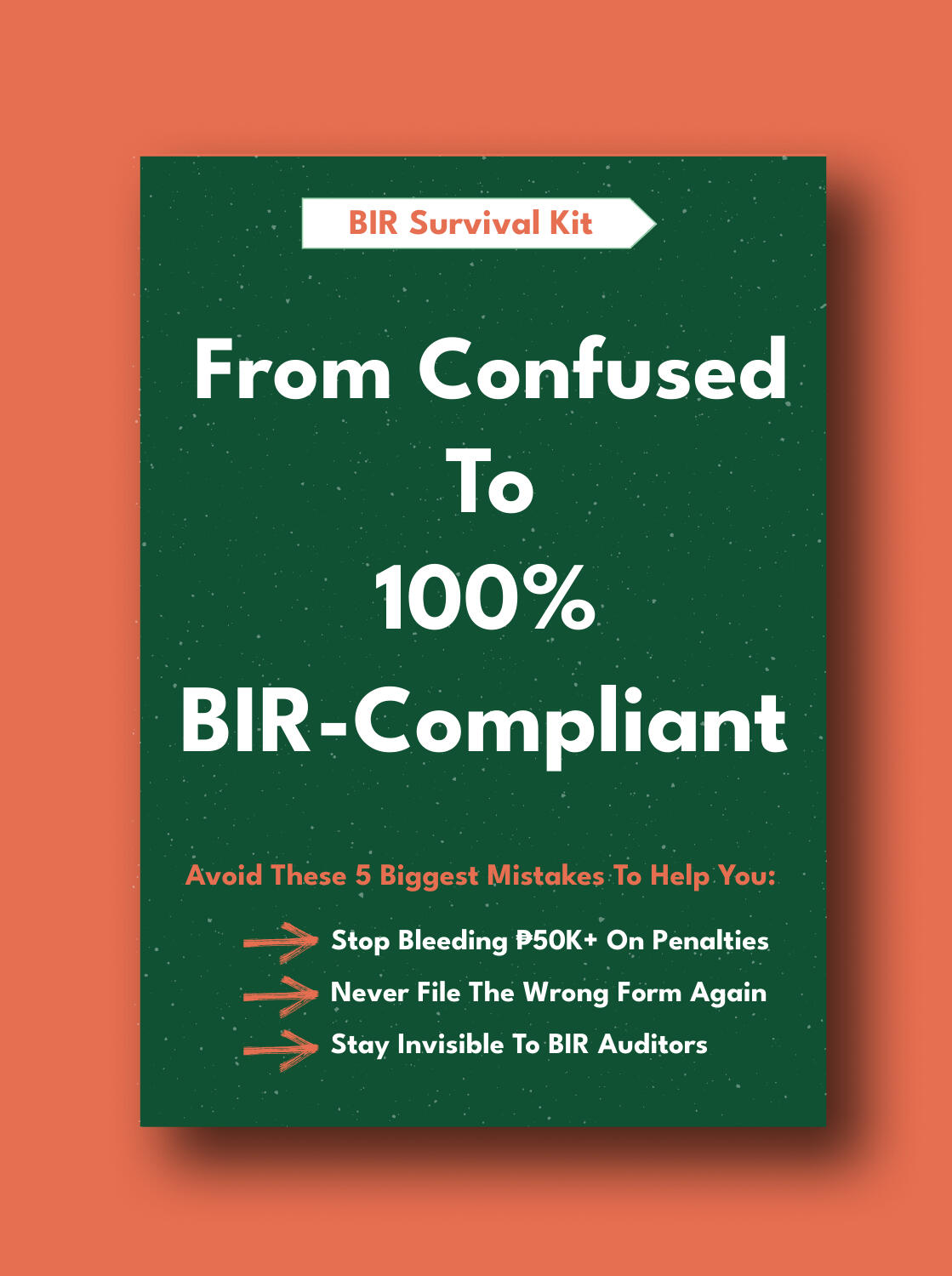

From Confused to 100% BIR-Compliant in 5 Days

(Even If You Already Registered Through a Fixer and Haven’t Earned a Peso Yet)

A FREE, 5-day email course breaking down everything you need to avoid ₱50K in penalties, file the right forms in your first 30 days, and stay audit-proof from day one

Over 500+ Philippine Business Owners Guided Through Hassle-Free Compliance

Created by Berna, who has...

Registered 500+ businesses with SEC & BIR.

Helped founders avoid ₱50K–₱100K in surprise penalties.

Backed by a trusted team of licensed CPAs for tax compliance.

Ready to finally become penalty-proof?

Here's a sneak peek of everything you're going to learn inside this email course:

Day #1. Mistake #1: Missing the BIR 30-Day ComplianceDay #2. Mistake #2: Failure to File ‘No Operations’ ReportsDay #3. Mistake #3: Not Issuing BIR-Registered InvoicesDay #4. Mistake #4: Filing The Wrong Tax FormDay #5. Mistake #5: Trusting A Fixer To Handle EverythingBONUS. How To Use Our CPA's Penalty Calculator (Interactive Google Sheet)

Hooray! The first lesson of BIR Survival Kit is on its way to your inbox.

Within the next minute or two, you're going to get an email from me (Berna Mitra)This email contains instructions to get started with our BIR Survival Kit, so be sure to check it out!But if you have any questions, don't hesitate to hit reply and let me know—I'll be happy to help! :-)Now go and check your inbox!

P.S. If you don't find the email in your inbox in the next couple of minutes, please check your spam folder...Chances are it ended up there.(Since I'm relatively new to sending emails to my list, sometimes the "email algorithms" think I'm a robot! 🤷🏻)